A gap is nothing but an empty space formed between two successive

candles

(or bars) representing a change in the exchange rate of a currency

pair. Generally, when a candle gets completed according to the time

frame used by a Forex trader, the next candle will open such that there

will be an overlap of the closing price of the completed candle and the

opening price of the new candle. However, in a gap formation, there will

be a huge gap between the closing price of the completed candle and the

opening price of the new candle. The new candle can form above or below

the completed candle as shown in the figures below.

|

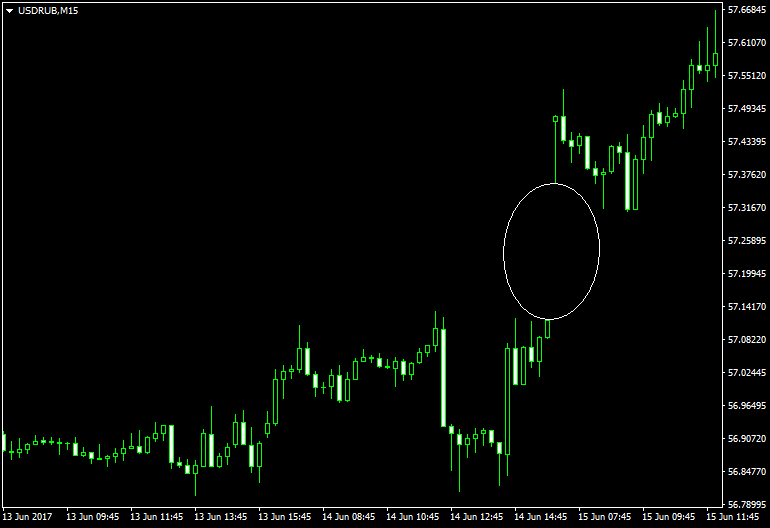

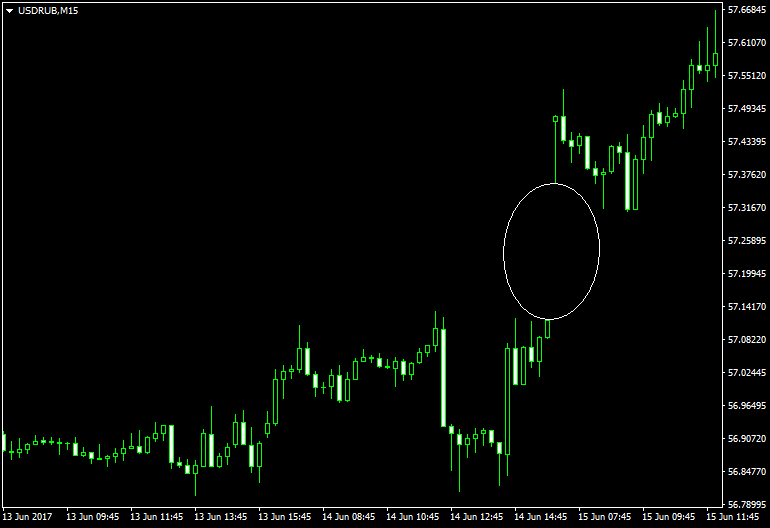

| An example of a positive Forex gap: |

|

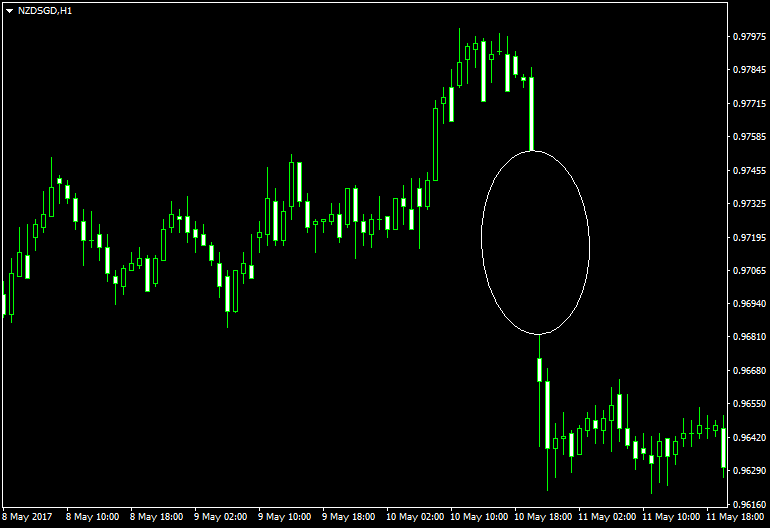

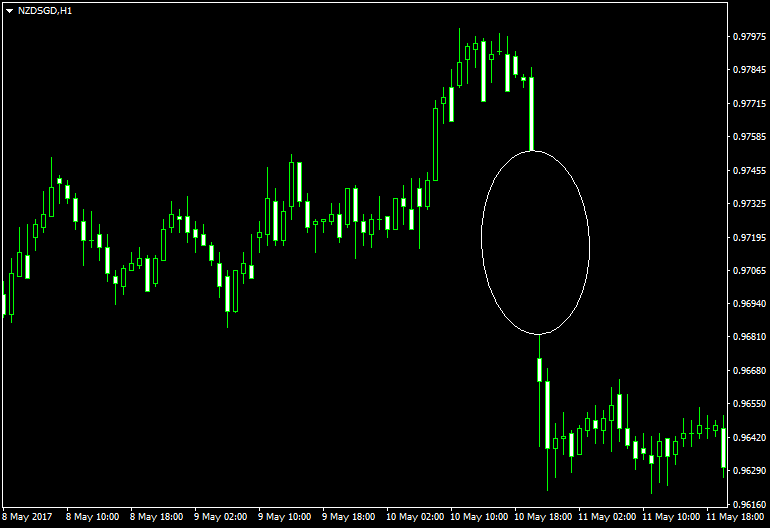

| An example of a negative Forex gap: |

Why does a gap form.