|

| A short position on EURJPY profiting with over 295 pips. ( Trading the exhaustion gap on the Asian open.)

Forex Gap Strategy — is an interesting trading system that utilizes one of the most disturbing phenomena of the Forex market — a weekly gap

between the last Friday's close price and the current Monday's open

price. The gap itself takes its origin in the fact that the interbank

currency market continues to react on the fundamental news during the

weekend, opening on Monday at the level with the most liquidity. The

offered strategy is based on the assumption that the gap is a result of

speculations and the excess volatility, thus a position in the opposite

direction should probably become profitable after a few days.

Features

How to Trade?

Example

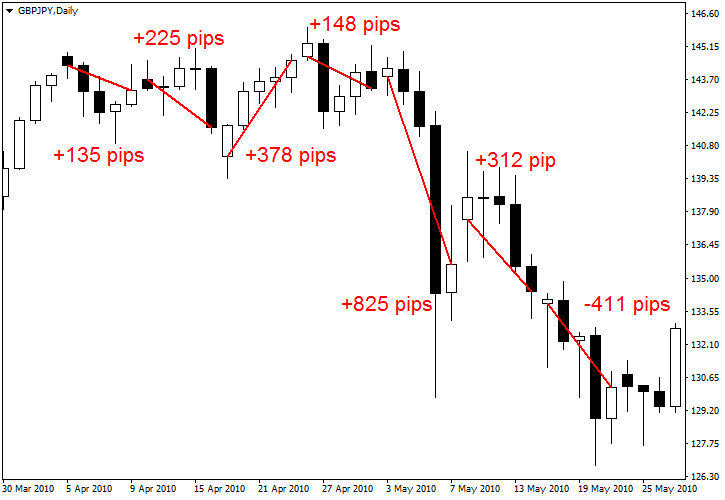

You can see GBP/JPY pair's last 7 weeks (as of May 24, 2010) and all

of them have gaps. 6 out of 7 gaps give correct signals that result in a

lot of profit. The last gap gives a wrong signal and yields a medium

loss. The average spread for GBP/JPY was 3 pips during the example

period and all gaps were much wider than 15 pips, making them all

qualifying signals. The net total profit was 1,612 pips in 7 weeks — not

that bad.

|

Forex Trade Africa is a brand and a social networking platform that was formed to educate people on ways to make money trading the financial markets and create awareness of this lucrative source of income that can change the lives of people not only in Kenya and Africa but also worldwide. Get in touch with us for more information.