A gap formation occurs when the sentiment turns extremely bullish or bearish towards a currency (or any other asset). Gaps can occur in any timeframe and can happen at any time. However, Forex markets being highly liquid, gaps are formed usually at the beginning of a new trading week.

When there is a sudden change in the sentiment, buyers or sellers would make a frantic attempt to enter or exit a position. That would create a price gap on the upside or the downside. If the sentiment has turned bullish all of a sudden, then Forex traders having a short position in a currency would try to outbid each other, thereby creating a huge price gap on the upside.

Likewise, if the sentiment has turned bearish suddenly, then Forex traders having a long position would compete to exit at the earliest, thereby creating a huge price gap on the downside. Unexpected economic or political news causes a change in the sentiment required to produce big currency rate gaps.

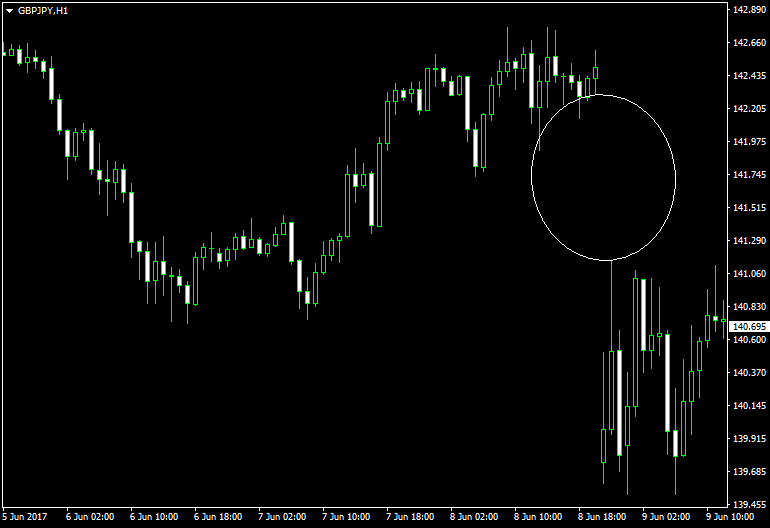

For example, back in April 2017, when Theresa May, the Prime Minister of the United Kingdom, announced snap election, a majority of market participants anticipated a huge victory for the Conservatives. Surprisingly, Theresa May and her party lost the majority, and the election resulted in a hung parliament. That dampened the sentiment towards the Great Britain pound, thereby leading to a negative gap opening in the GBP pairs.

|

| Formation of a gap on GBPJPY back in April 2017. |

It is not uncommon to see the price reverse at some point in time and close a gap created previously. However, there is no guarantee that it would happen. Even in the case of a price reversal, there is no definite time frame for the gap to be filled. Depending on the strength of the underlying sentiment, a gap may be filled within a day, week, after several months, or never at all.

Depending on the nature of formation, gaps can be grouped into four categories.