Below are the common types of gaps that you will encounter in your trading career.

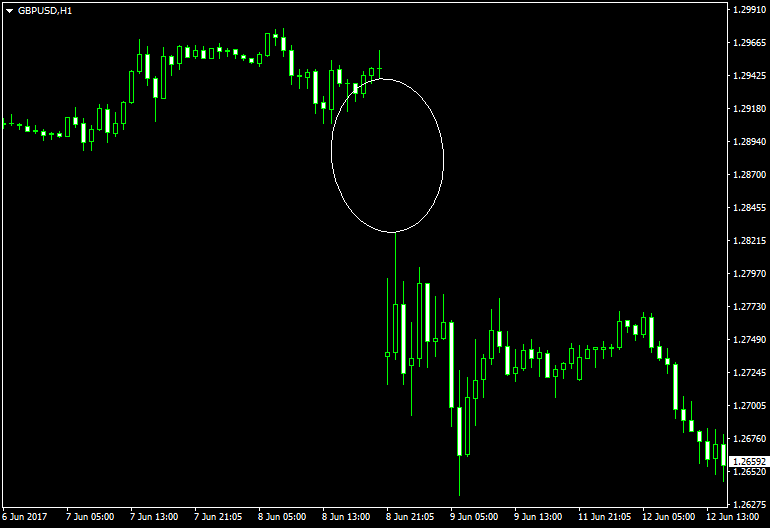

Breakaway Gap

A breakaway gap can be seen at the beginning of a big price movement and at the end of a consolidation phase of a currency pair. Since such gaps are formed when a currency pair breaks out of a non-trending pattern to a trending pattern, it is referred to as a breakaway gap.The GBP/USD pair formed a breakaway gap on June 8, 2017, following the exit polls' prediction of hung parliament in the UK.

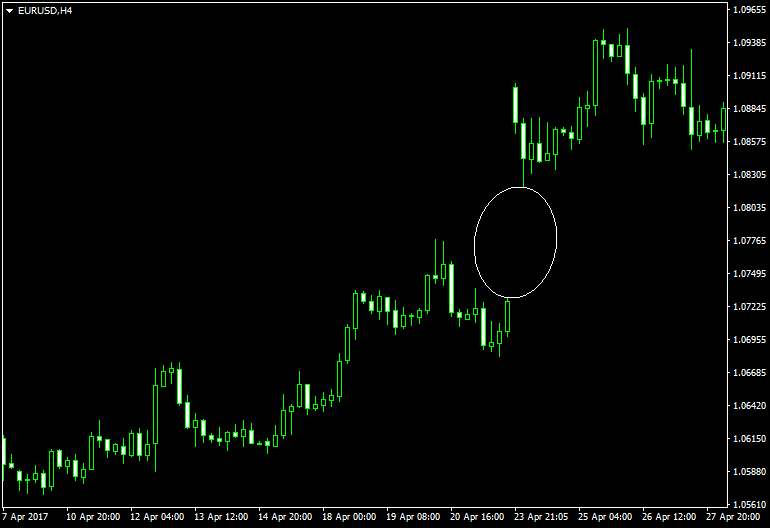

Runaway or Continuation Gap

It is formed around the middle of an uptrend or downtrend of a currency pair. Since the trend remains unchanged after the formation of the gap, it is one of the most reliable patterns to trade with. The image below shows a continuation gap formed by the EUR/USD pair on April 23, 2017.

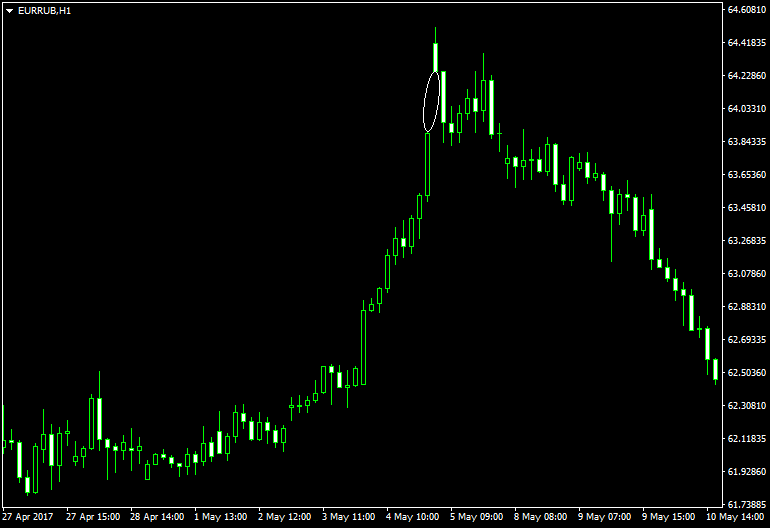

Exhaustion Gap

An exhaustion gap is usually seen in the final leg of a downtrend or an uptrend. The pattern is confirmed on the basis of low volumes. The EUR/RUB chart below shows an exhaustion gap formed few days before the second round of the French election, conducted on May 8, 2017.

Take a look at how i traded the exhaustion gap on EURJPY.

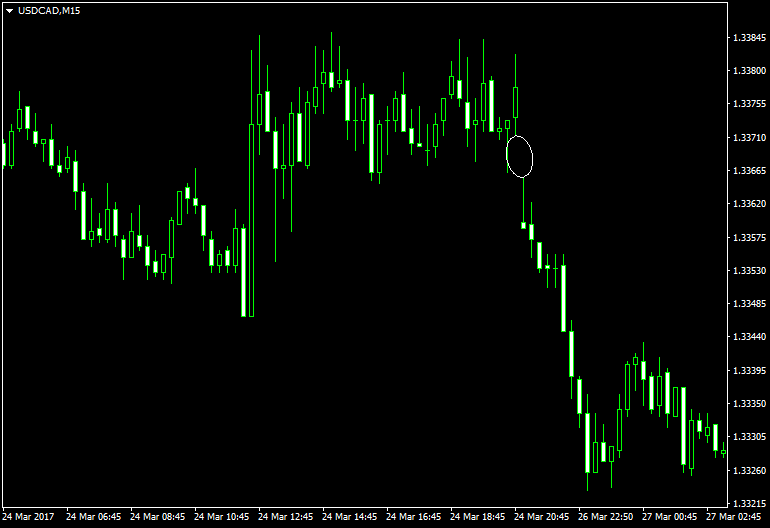

Common Gap

A common gap is formed when an overwhelmingly positive or negative news is announced. For example, retail sales, unemployment change, NFP, and GDP growth data can result in the formation of common gaps. When IHS Markit reported a lower than anticipated flash manufacturing PMI (US) on March 24, 2017, the USD/CAD pair made a common gap pattern as shown in the chart screenshot below. Earlier that day, Statistics Canada had reported better than expected core CPI data.

It would be an interesting opportunity to create trading strategies once you become well experienced in identifying price gaps and their nature as they form on the chart.

Alternatively, you can try using our Forex gap strategy developed for the weekly gaps in JPY-based currency pairs.