- size as measured by GDP

- whether it’s a reserve currency

- size of capital markets

- freedom from capital controls

Each of the majors is a reserve currency to a greater or lesser extent, with the US dollar holding over 65% of the share but the euro, pound and yen also used as reserve currencies. A top reason countries hold foreign currencies in reserve is to be able to buy food or military equipment on a moment’s notice with all sellers willing to take the reserve currency. The US dollar is the top reserve currency also because about 75% of world trade is denominated in dollars.

It is therefore not surprising that trade and capital-flow trading volumes are the highest among the major currency pairs. It really should be named major/major currency pair, since each currency is a major in its own right, combining two powerhouse currencies like the euro/dollar, euro/yen or pound/euro. When you combine a major currency (dollar) with a minor currency (Mexican peso), you get a minor currency pair.

Also “major” are the Swiss franc and the Canadian, Australian, and New Zealand dollars. The Swiss franc qualifies as major despite the relatively small size of the economy and financial markets because of its traditional role as a neutral country and a safe haven. Canada, Australia, and New Zealand qualify because they have first-class financial systems and are important suppliers of raw materials/commodities. Note that just about everyone will include the Swiss franc in any listing of major currency pairs, but not everyone will include the Canadian, Australian, or New Zealand dollars.

Not all major currencies are created equal. The US has the biggest government bond market (and the biggest corporate bond market), with foreign ownership of government notes and bonds at about 40%. Japan has a very large government bond market, too, but with foreign participation of about 10%. The European bond market is fragmented among the many members (the European Union has 28 members and the European Monetary Union, the countries that use the euro, has 19.)

Be Careful What You Read

When the financial press writes about “the dollar” or “the euro,” the reporters are actually making a mistake. To refer to any currency without naming the second currency of the pair is to cause confusion. When a reporter writes “the dollar went up,” which dollar is he referring to? It could be the dollar index, a futures contract based on a basket of currencies, or USD/JPY, or even EUR/USD, although to be accurate, then he should write “the euro went down.”In other words, there is no such thing as a single-name currency in the Forex market. All Forex currencies come in pairs, by definition. A useful way to think about currency pairs is to imagine the base currency, the one whose name comes first, as the Object, and the second-named in the pair as the money, with which you are buying or selling the Object. So, when you are buying EUR/USD because you believe the euro will go up and you can sell it later at a profit, the EUR is the Object, just like a stock, bond, or commodity, and you will be paying for the euros using money that happen to be denominated in dollars. You might just as easily be buying euros and paying for them with Japanese yen (EUR/JPY) or buying euros and paying for them with pounds (EUR/GBP).

Three Sets of Pairs

Majors

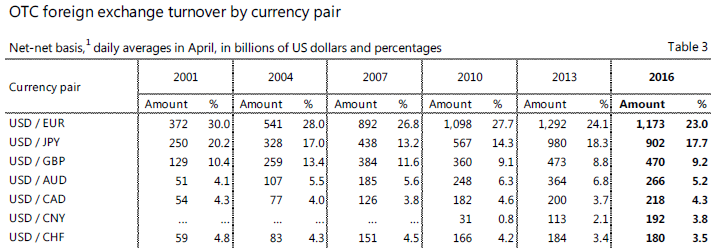

If we were using the BIS report as a reference point, we could say that a “major currency pair” is one that has more than 3% of daily turnover. There would be seven major pairs: EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD, USD/CNY, and USD/CHF. |

| OTC Forex turnover by currency pair - 3% and more. |

However, the current conventional definition would leave out the USD/CNY pair as it is rarely available to retail customers. At the same time, NZD/USD would be added due to high status of the New Zealand dollar. Also, such currency pairs as EUR/GBP, EUR/JPY, and GBP/JPY are normally considered majors despite lower trading volume.

Minor Currency Pairs

What makes a currency pair “minor” is inclusion of a currency whose country has a relatively small or undeveloped financial market, both stocks and bonds. A “minor” currency country can have a very large economy, like China or Russia, but still be considered minor because its currency does not float freely. Minor currencies include some developed market and some emerging market currencies. An example of the developed market minor currency is the South Korean won.Minor currencies include the Mexican peso, Chinese yuan, South Korean won dollar, Swedish krone, Russian Ruble, Norwegian krone, Hong Kong dollar, Singapore dollar and Turkish lira. In the retail spot Forex market, the “minor” currencies are now generally named “exotic,” although some analysts save the word “exotic” for a currency consisting of two minors, like the South African rand/Turkish lira. Most minor pairs have a very low share of total Forex trading volume. The EUR/TRY, for example, has 0.1% and the USD/TRY has 1.2%.

There are many other currencies that are considered minor currencies, such as the Polish zloty, Hungarian forint, South African rand, Brazilian real, to name a few. In Poland and Hungary, expectations of full membership in the European Monetary Union has already led to the euro being in wide use. Poland is expected to join in 2020, but Hungary does not have a specific target date.

Again, combining a major currency with a minor one does not make the pair a “major” pair. It stays minor.

Cross Rates

Traders create a cross rate by taking two currency pairs such as EUR/USD and USD/MXN and combining the two. By canceling out the duplicate currency, the trader creates a hybrid currency pair or a “cross” such as EUR/MXN. The resulting currency pair has a negligible trading volume despite the fact that EUR/USD is the most traded currency pair and USD/MXN is also a popular one.There are endless possibilities in terms of combinations, but the more esoteric the combination, such as a TRY/KRW (Turkish lira vs. South Korean won) cross, the wider the spread and the less liquidity generally available.

Liquidity is usually readily available and spreads are reasonably tight in the major crosses, which also include AUD/CAD, AUD/JPY, EUR/AUD, and CAD/JPY. Even in the minor crosses such as EUR/PLN (euro vs. Polish zloty) and EUR/RUB (euro vs. Russian ruble), under normal circumstances, prices can easily be found, although not always on larger amounts.