The world's interest rates

When we talk about interest rates, we usually think about central bank monetary policy. When the expected interest rate changes, the currency usually follows it. Central banks have different monetary policy tools to influence its movements.There are two major tasks usually performed by central banks, including inflation management and maintenance of the country’s exchange rate stability. Rates usually reflect the health of particular economies. Central banks tend to raise interest rates when the economy is growing, and therefore induce inflation. On the other hand, the decline of interest rates during times of economic slowdown usually serves as a means of stimulating a struggling economy.

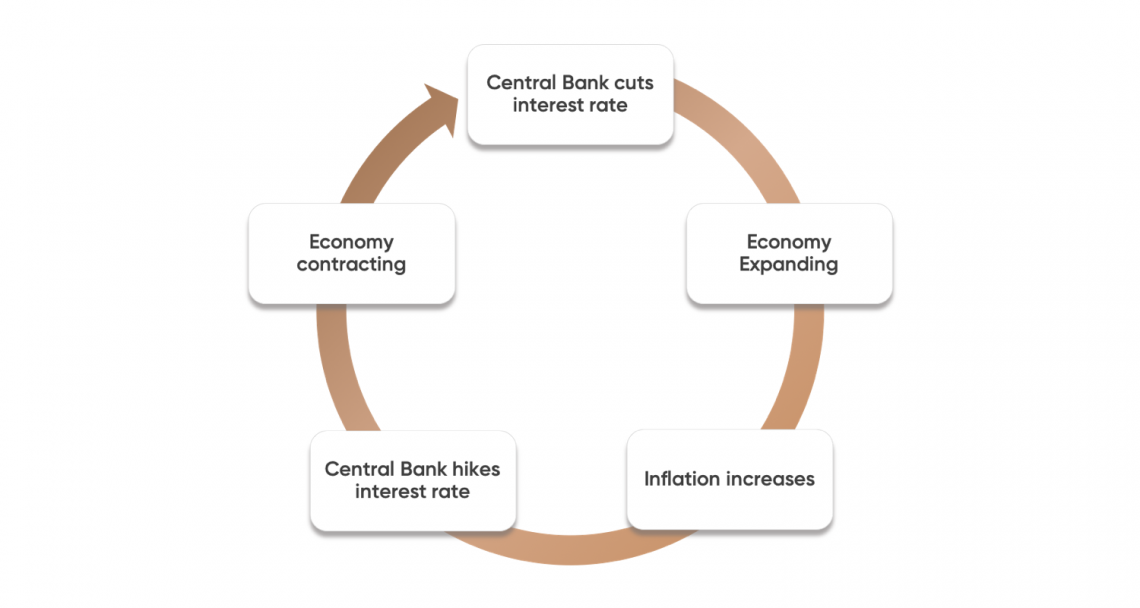

Economies are always on the move, either expanding or contracting. The major goal of central banks is to keep an eye on inflation rates, allowing the economy to grow steadily.

The economic cycle and interest rates

When economies are on the rise and GDP experiences positive growth, consumers start earning more. More earnings bring more spending, which eventually triggers inflation growth. The central bank tries to keep inflation under control and support the target level – which is 2% for the majority of central banks – by means of increasing interest rates.If economies are receding and GDP experiences negative growth, deflation poses a new threat. In this case, the central bank lowers the currency interest rate to stimulate spending and investments. Low interest rates attract more investors. They invest in different projects, which eventually spurs further growth, employment and, as a result, inflation.

Keep track of an interest rate’s effect on currency. The higher the country’s interest rate, the more chances its currency will grow.

A typical economic cycle looks like this:

|

Interest rates expectations

Markets never sleep, constantly changing in anticipation of various events. Interest rates change as well. The majority of forex traders never concentrate on the current interest rates, trying to forecast in which direction interest rates are expected to move.They should also remember that interest rates are shifting along with the central bank’s monetary policy, and depend on the beginning and the end of monetary cycle.

If the interest rate is moving lower and lower over and over again, it will inevitably turn around. A shift in expectations triggers a shift in speculation, which will gain momentum right before the rate change is set to be announced.

Along with a gradual shift, interest rates can change in a single moment following just one single report. In short, keep your eyes wide open.

Interest rate differentials

A widely applied forex trading technique is to compare one currency’s interest rate to another in order to determine whether the currency is going to strengthen or weaken.An interest rate differential is the difference between the two interest rates. It may also help you to find out the possible currency shifts, which may not be so obvious. When the interest rates of the 2 currencies go in opposite directions, the forex market witnesses the largest swings. The sharpest fluctuations happen when the interest rate of one currency is rising while the interest rate of another is falling.

Nominal vs real interest rates

What is the difference between nominal and real interest rates? The nominal rate is usually the base rate that you will most often see. Essentially, it is the rate of interest before being adjusted for inflation. |

Markets usually don’t focus on the nominal rate, preferring the real interest rate.

Forex interest rate trading strategies

Well, how you can predict central bank rates and their impact on the forex market?First of all, interest rate traders should track what central bankers are currently monitoring. Usually central bankers are transparent to the public about what economic factors they consider and when they expect an increase of interest rates.

Central banks increase and decrease interest rates according to several economic factors. To learn more about these data points, you can use an economic calendar, which tracks the upcoming economic events and rank them according to their importance and potential to shake the markets as “low”, “medium” and “high”.

Advanced forex traders will have to predict the central banks’ further actions before they announce them to the public. They can do this by tracking the key economic variables, such as inflation, unemployment rate, etc.

If

this approach seems too difficult, you can trade the result of the

central bank news release. This strategy can be called “trading the

news”.